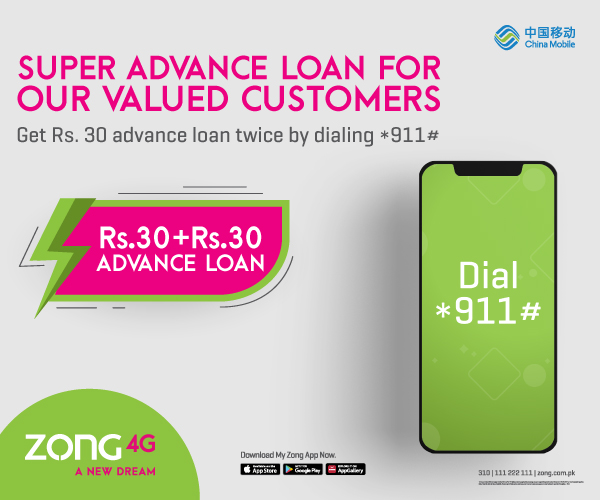

Zong Super Advance loan

Out of Balance? Need to contact someone immediately? Opt for Zong Advance Loan which provides you with Instant Loan which you can utilize to make Calls, send an SMS or browse the internet. To provide you with more convenience, now Zong valued customers can get Super Advance loan of Rs. 60 i.e. Rs. 30/Loan transaction per recharge. To be eligible for Super Advance loan Customer must have recharge PKR 660 in last 3 months. Whereas customer with monthly recharge of less than Rs. 660 in last three months can also enjoy advance loan of Rs. 30 i.e. Rs. 15/Loan transaction per recharge. So that you can avail Loan balance as per your needs.

Service details are as below:

- Customer with monthly recharge amount of greater than Rs. 660 in last 3 months will be eligible for Super advance loan of Rs. 60 i.e. Rs. 30/loan transaction per recharge.

- Customer with monthly recharge amount of less than PKR 660 will be eligible for PKR 30 loan i.e. PKR 15 per transaction per recharge.

- Each Zong customer is now eligible for 2 Advance Loan transactions per recharge.

- Loan amount per Advance Loan transaction is Rs.15 for low recharge customer and Rs. 30 per transaction for high recharge customer.

- Advance service fee is Rs.4.5+tax per Advance Loan transaction for standard customer.

- Advance service fee is Rs 8+tax per advance loan transaction for super advance customers.

- Customers can get single or double Advance Loans as per their requirement.

SERVICE MECHANICS:

- Dial *911#. If you want a 2nd Advance Loan dial *911# again after receiving the first Advance Loan balance.

- Send blank SMS to 6911. If you want a 2nd Advance Loan “Send blank SMS to 6911” again after receiving the first Advance Loan balance.

- Download My Zong App and go to loan section from home screen and tap “Get Loan” button. If you want a 2nd Advance Loan, tap “Get Loan” button again after receiving the first Advance Loan balance.

Price

Upon recharge, the below mentioned amount is deducted from the customer account

- If single Advance Loan is taken

- Standard Advance Loan Amount Rs.15

- Standard Service charges Rs.4.5+ Tax

- If two Standard Advance Loans are taken:

- Advance Loan Amount Rs.30

- Service charges Rs.9.0+ Tax

- If single Super Advance Loan is taken:

- Super Advance loan Amount Rs 30

- Super Service charges Rs 8+Tax

- If Two Super Advance Loans are taken:

- Advance loan Amount Rs. 60

- Services Charges are Rs 16+Tax

FAQ

- Q. What is the Advance Loan amount?

- A. The Advance Loan amount is PKR 30 total for Standard value customer and Advance loan amount will be PKR 60 Total for High Value Customer. Customer will get PKR 15/loan transaction in case of Standard value whereas PKR 30/Loan transaction in case of High-Value Segment and max 2 advance loan transactions are allowed on one recharge

- Q. What are the service charges of Advance Loan?

- A. Service charges are Rs.4.5+Tax/loan transaction for Low value of existing customers, Rs. 8 + tax per transaction for Super advance/loan transaction.

- Q. How to take Super Advance Loans?

- A. Customer who has performed a recharge of PKR 660 in the past 3 months can take Super Advance loan and will be required to separately activate both Advance Loans from any given channel (USSD, SMS, IVR, MZA etc)

- Q. What is the payback amount?

- A. The minimum recharge for Normal Advance Loan customers (for loan amount of Rs.15 or Rs.30) will be Rs.50. Minimum recharge amount for Super Advance Loan customers will be based on their outstanding loan amount. If the outstanding loan amount of Super Advance customer at the time of balance recharge is Rs.30 then minimum recharge required will be Rs.50. If the outstanding loan amount of Super Advance customer at the time of balance recharge is Rs.60 then minimum balance recharge required is Rs.100.)

- Q. Who can avail Advance Loan?

- A. Prepaid users can avail advance loan.